TATA AIA Life Term Insurance Plan: TATA AIA term plans give longer life cover of up to 85 years of age or for whole life coverage which is till the age of 100 years.

You have the flexibility to choose four death benefit options

- Option 1 – “Sum Assured on Death” as Lump Sum benefit on Death

- Option 2 – “Sum Assured on Death” as Lump Sum benefit on Death & Monthly Income for the next 10 years

- Option 3 – “Enhanced Sum Assured on Death” as Lump Sum benefit on Death

- Option 4 – “Enhanced Sum Assured on Death” as Lump Sum benefit on Death & Monthly Income for the next 10 years.

TATA AIA offers higher protection discount of up to 25% for a sum assured of over Rs. 75 Lacs.

TATA AIA Term Life Insurance Individual Death Claims Paid Ratio – 94%

TATA AIA Life Insurance Policy Terms

| Minimum age at entry | 18 years |

| Maximum age at entry | Up to 70 years |

| Max. Maturity age | 85 years Whole Life cover 100 years |

| Min. Sum Assured | Rs. 50 Lacs |

| Max. Sum Assured | No limit Subject to underwriting policy |

| Policy term | Min. 10 years Max. 85 years OR 100 less age at entry years |

| Premium payment term | Annual, semi-annual, quarterly or monthly |

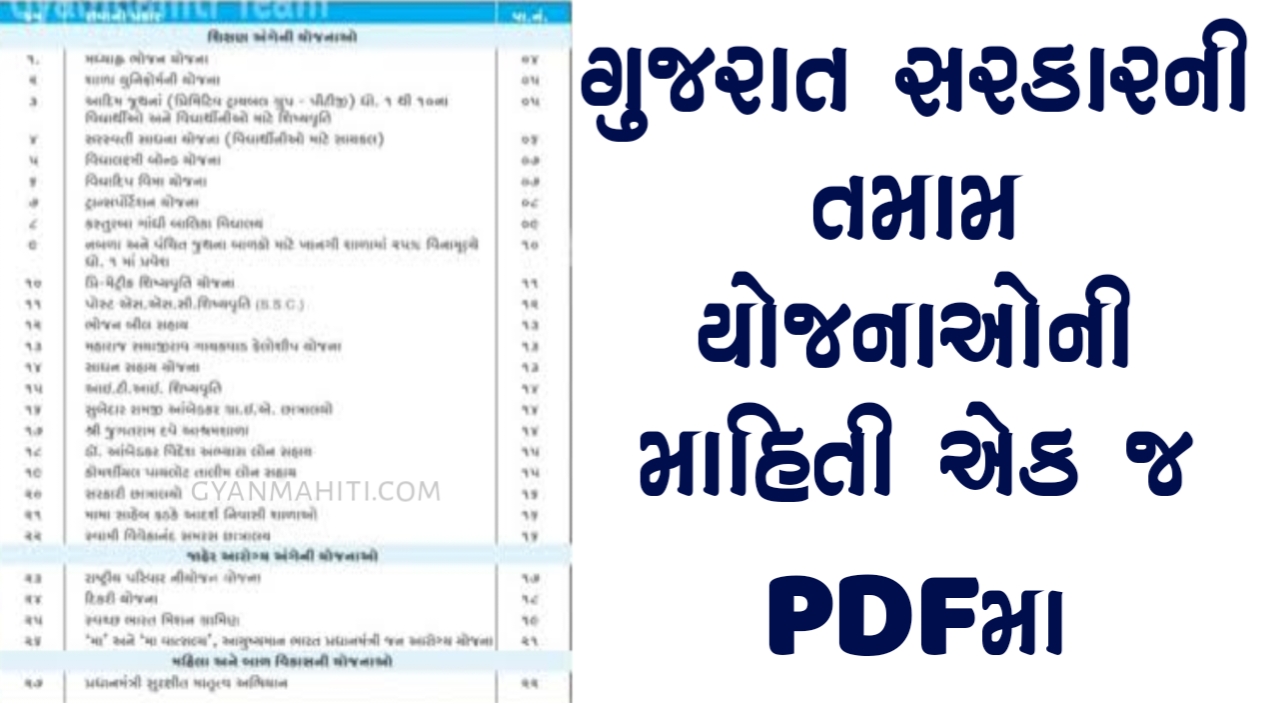

| Download Yojana Pdf | View |

Riders

- TATA AIA accidental death and dismemberment rider

- TATA AIA waiver of premium plus rider

TATA AIA Life Best Term Insurance Plans

- TATA AIA Life Sampoorna Raksha Plan

- TATA AIA Life Sampoorna Raksha+ Plan

- TATA AIA Life iRaksha TROP Plan

- TATA AIA Life Maha Raksha Supreme Plan

What I Liked

- Whole life covers up to 100 years

- Higher protection premium discount on Rs. 75 Lacs+ sum assured

What I Didn’t Like

- Loading on monthly premium payments

Tata AIA Life Insurance Company Limited offers a variety of life insurance plans, including:

- Term plans: Can provide a large life cover at a lower premium

- Savings plans: Can offer guaranteed returns on maturity

- Retirement plans: Can offer guaranteed returns on maturity

- Protection plans

- Wealth plans

- Child plans

- Group plans

- Micro-insurance plans

Tata AIA also offers health insurance plans, which provide financial aid for health-related expenses, such as hospitalization and treatment costs for injuries, minor infections, and critical illnesses. Tata AIA’s health insurance plans include:

- Child Care Cover

- Hospital Cover

- Disability Cover

- Death Cover

- Whole Life Cover

- Family Coverage

- Indexation Benefit

Tata AIA also offers accident and health insurance, savings plans, employee benefits, credit life, and pension services to corporate clients.