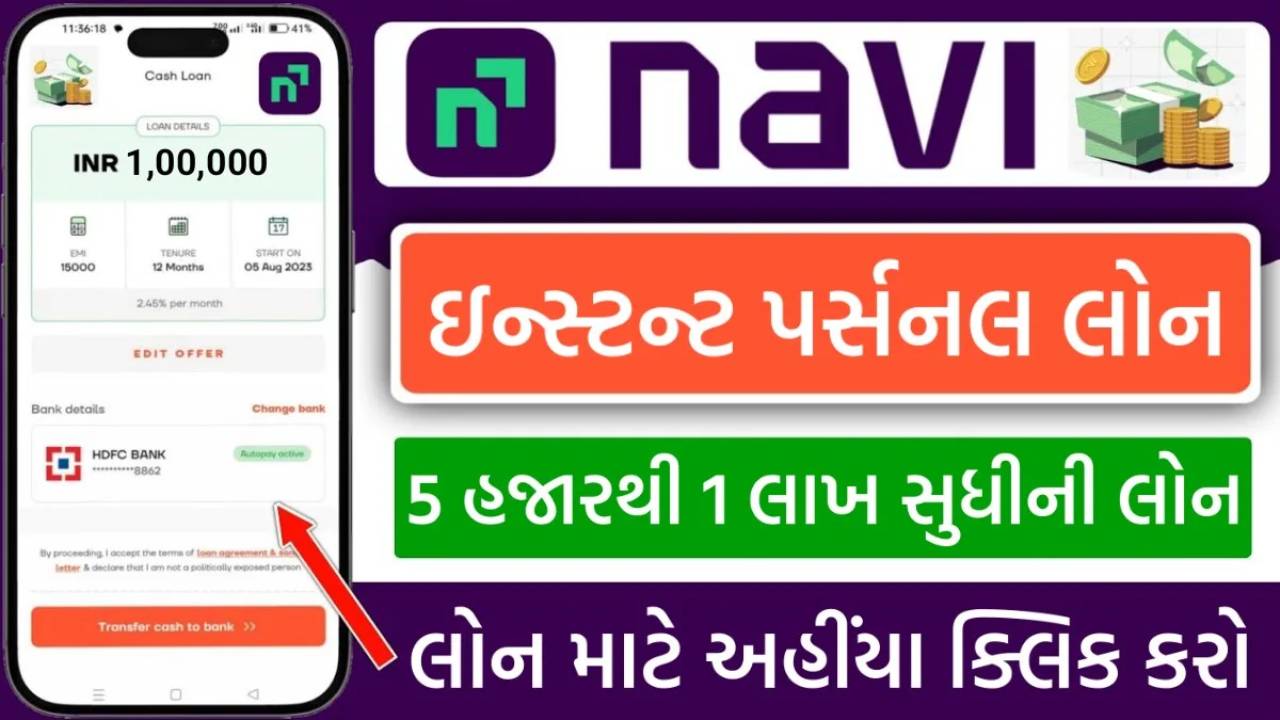

Navi App Personal Loan: Navi App is an easy and fast instant personal loan app that offers personal loans especially from Rs 5,000 to Rs 1 lakh. The process of getting a loan through this application is very simple and brief. You can choose the loan amount as per your requirement and the loan can be approved within minutes after just checking the KYC documents. Navi App also offers EMI plans and flexible payment options, making it more convenient for common people.

Navi App Personal Loan Highlights

| step | description |

| 1. Download Navi App | Download Navi App from Google Play Store or Apple App Store. |

| 2. Sign-up with mobile number | Sign-up via OTP by entering your mobile number. |

| 3. Select the loan amount | Choose a loan amount from Rs 5,000 to Rs 1 lakh. |

| 4. Complete the KYC process | Upload identity and address proofs like PAN card and Aadhaar card. |

| 5. Loan Approval and Offer | Based on the information provided will approve your loan and present a loan offer. |

| 6. Consent and Loan Disbursement | Agree to the terms of the loan and the loan amount will be transferred to your bank account. |

Procedure to get Navi App Loan

The process of availing personal loan from Navi App is very easy. Below are the steps for the same:

- Download Navi App: Download Navi App from Google Play Store or Apple App Store.

- Sign-up with mobile number: Sign-up on the website through OTP by entering your mobile number.

- Choose Loan Amount: Choose a loan amount from 5,000 to 1 Lakh for Personal Loan on Navi App.

- Complete KYC Process: Upload identity and address proof like PAN Card and Aadhaar Card to get your KYC done.

- Loan Approval and Offer: Navi App will approve your loan and present a loan offer based on the information provided.

- Agreement and Loan Disbursement: Agree to the loan terms and the loan amount will be transferred to your bank account instantly.

With Navi App you can get a personal loan in minutes, and it’s completely online, meaning, no need to go to the bank.

Navi App Eligibility and Criteria

Eligibility and criteria for availing personal loan through Navi App are as follows:

Eligibility

age: Applicant age should be between 21 to 60 years.

Bank Accounts: You must have an active bank account in your name, where the loan amount can be transferred.

Income: Proof of monthly income is required, which shows your ability to pay.

Criteria

Paperwork: Upload of PAN card and address proof (Aadhaar card, utility bill, etc.) is required for identification.

Tenure: The loan tenure can generally be between 3 months to 36 months.

Non-disclosure: It may be difficult for an applicant who has any previous negative credit record to get a loan approval.

These eligibility and criteria need to be kept in mind while applying for personal loan through Navi App.

Navi App Required Documents

Following documents are required while applying for personal loan through Navi App:

PAN Card: PAN card is required as proof of identity.

Aadhaar Card: Aadhaar card can be viewed for address verification.

Label Record: Last 3 months fixed salary statement or Income Tax Return (ITR) for self-employers as proof of salary.

Bank Statement: Includes bank statements for the last 3-6 months.

Other identity proofs: If required, different identity proofs like water board, gas connection bill, etc.

After completing these documents, you can easily apply for a personal loan through Navi App.

Conclusion

Navi App is a modern and fast personal loan application, which provides easy access to loans from Rs 5,000 to Rs 1 lakh. Its process is simple and useful, including gentle KYC verification, quick approval and instant transfer of loan amount. The list of required documents is concise and simple, so that even new users can easily use the application. With Navi App, people can meet their financial needs quickly and accurately, which facilitates financial gain.

Important Links

| Navi App | View |

Thanks for visiting this useful post, Stay connected with us for more Posts. Visit every day for the latest offers of various brands and other technology updates.