CIBIL Score Check Online : CIBIL score check online: Best source of free CIBIL is site of CIBIL itself. CIBIL provides you with the first report free of cost. You may file for resolution also over there if you find any loan inappropriately mentioned in your CIBIL report.

CIBIL report is also available free of cost on many sites which sell financial products. But the personal information provided there is utilized by these sites to pitch for sales latter on and you would be bombarded with lots of messages and calls.

Do not unnecessarily generate your CIBIL report very often as it downgrades your score and raises concerns in the mind of banks. So if you approach a bank for loan, after repeated CIBIL enquiry, it will raise doubts regarding the reasons for generating the CIBIL report so frequently.

What is the CIBIL Score?

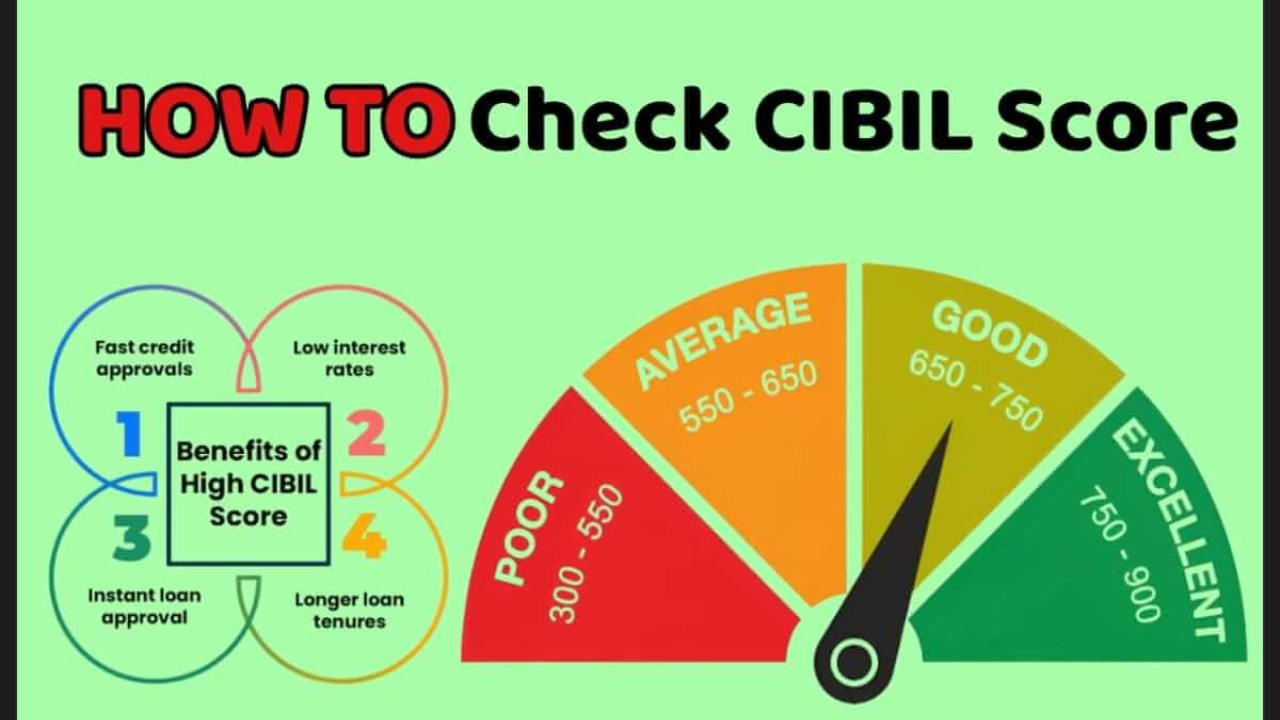

A CIBIL Score is a three-digit number (ranging from 300 to 900) that represents your creditworthiness based on your borrowing and repayment history. It is generated by TransUnion CIBIL, India’s leading credit bureau.

Key Features of CIBIL Score:

- Ranges from 300 to 900 (higher is better)

- Based on credit history, repayment behavior, and credit utilization

- Used by banks and lenders to approve loans & credit cards

- A score above 750 is considered good

Importance of CIBIL score check online

Checking your CIBIL Score online helps you:

- Know your loan eligibility before applying for a loan or credit card

- Detect errors in your report that may affect your score

- Prevent loan rejections by improving your score in advance

- Monitor credit activity and ensure no unauthorized transactions

- Identify fraudulent accounts if someone misuses your identity

CIBIL Score Range and What It Means

| CIBIL Score Range | Creditworthiness | Loan Approval Chances |

|---|---|---|

| 750 – 900 | Excellent | Very High |

| 700 – 749 | Good | High |

| 650 – 699 | Fair | Moderate |

| 550 – 649 | Poor | Low |

| 300 – 549 | Very Poor | Very Low |

Tip: Aim for a CIBIL score of 750+ for easy loan approvals & lower interest rates.

How to Check Your CIBIL Score for Free

You can check your CIBIL score online for free without a PAN by following these steps:

- Visit the CIBIL Website: Go to the official CIBIL website (www.cibil.com).

- Navigate to the Free Credit Score Section: Look for the option to check your credit score for free. CIBIL often provides a free score report once a year.

- Provide Required Details: You may need to provide some personal information such as your name, date of birth, mobile number, and email address.

- Use Alternative Identification: Since you don’t have a PAN, CIBIL may allow you to verify your identity using other documents, such as your Aadhaar number or any other identification proof.

- Verify Your Identity: Follow the verification process, which may include receiving an OTP on your registered mobile number.

- Access Your Score: Once verified, you should be able to access your CIBIL score and report without needing a PAN.

If you encounter any issues, consider reaching out to CIBIL’s customer support for assistance. Additionally, be cautious of third-party websites that claim to provide free credit scores, as they may not be secure or reliable.

Steps to Check CIBIL Score for Free on Ruloans

- Visit the Ruloans website: https://www.ruloans.com

- Click on “Check Your Credit Score”

- Enter basic details (Name, Mobile Number, PAN Card, Email)

- Verify OTP sent to your mobile

- Get your CIBIL Score instantly

Note: Checking your CIBIL score via Ruloans does NOT affect your score.

Key Factors That Impact Your CIBIL Score

Factors That Increase CIBIL Score:

- On-time loan & credit card payments

- Low credit utilization (Use less than 30% of your credit limit)

- Long credit history (Old credit accounts improve scores)

- Diversified credit mix (Loans + credit cards)

- Minimal hard inquiries (Avoid too many loan applications)

Factors That Lower CIBIL Score:

- Late or missed payments

- High credit utilization (Using 80-100% of your credit limit)

- Frequent loan applications (Too many inquiries reduce score)

- Defaults on loans or credit cards

- Lack of credit history (Having no loans or credit cards)

What is a Credit Score?

A Credit Score is a numerical representation of a person’s ability to repay borrowed money. It is generated by credit bureaus such as:

- TransUnion CIBIL

- Experian

- Equifax

- CRIF High Mark

- Difference Between Credit Score & CIBIL Score:

- CIBIL Score is a type of credit score calculated by TransUnion CIBIL.

- Credit Score is a general term used for scores given by any credit bureau.

Why Should You Check Your Credit Score?

- Before applying for a loan or credit card

- To monitor financial health

- To correct any errors in your credit report

- To prevent identity theft or fraud

- To improve your score before taking a big loan (home loan, car loan, etc.)

Tip: Banks & NBFCs check your credit score before approving loans & deciding interest rates.

Benefits of Maintaining a Good Credit Score

| Benefit | Impact |

|---|---|

| Higher Loan Approval Chances | Easier approval for home loans, car loans, personal loans, etc. |

| Lower Interest Rates | Banks offer loans at lower interest rates to borrowers with 750+ score. |

| Higher Credit Card Limits | A good score increases your credit limit. |

| Faster Loan Processing | Lenders approve loans quickly if you have a high credit score. |

| Better Negotiation Power | You can negotiate for better interest rates and loan terms. |

| No Need for a Guarantor | With a high score, loans can be approved without a guarantor. |

Tip: A CIBIL score above 750 ensures easy approvals & better financial benefits.

How to Increase Your CIBIL Score?

Do’s to Improve Your CIBIL Score:

- Pay bills & EMIs on time – Avoid late payments

- Use less than 30% of your credit card limit

- Maintain a good credit mix – Have both secured (home loan) & unsecured loans (credit cards)

- Check your credit report regularly – Correct errors if any

- Avoid frequent loan applications – Too many inquiries lower your score

Don’ts That Hurt Your CIBIL Score:

- Missing loan/credit card payments

- Applying for too many loans at once

- Closing old credit cards (Longer credit history improves your score)

- Having only unsecured loans (Personal loans & credit cards)

Tip: A few months of disciplined credit behavior can improve your CIBIL score significantly!

Final Thoughts

Maintaining a high CIBIL score (750+) helps in getting better financial opportunities, including higher loan approvals, lower interest rates, and faster loan processing. Regularly checking your credit score allows you to monitor your financial health and make better borrowing decisions.

| Official Website | View |

Thanks for visiting this useful post, Stay connected with us for more Posts. Visit every day for the latest offers of various brands and other technology updates.