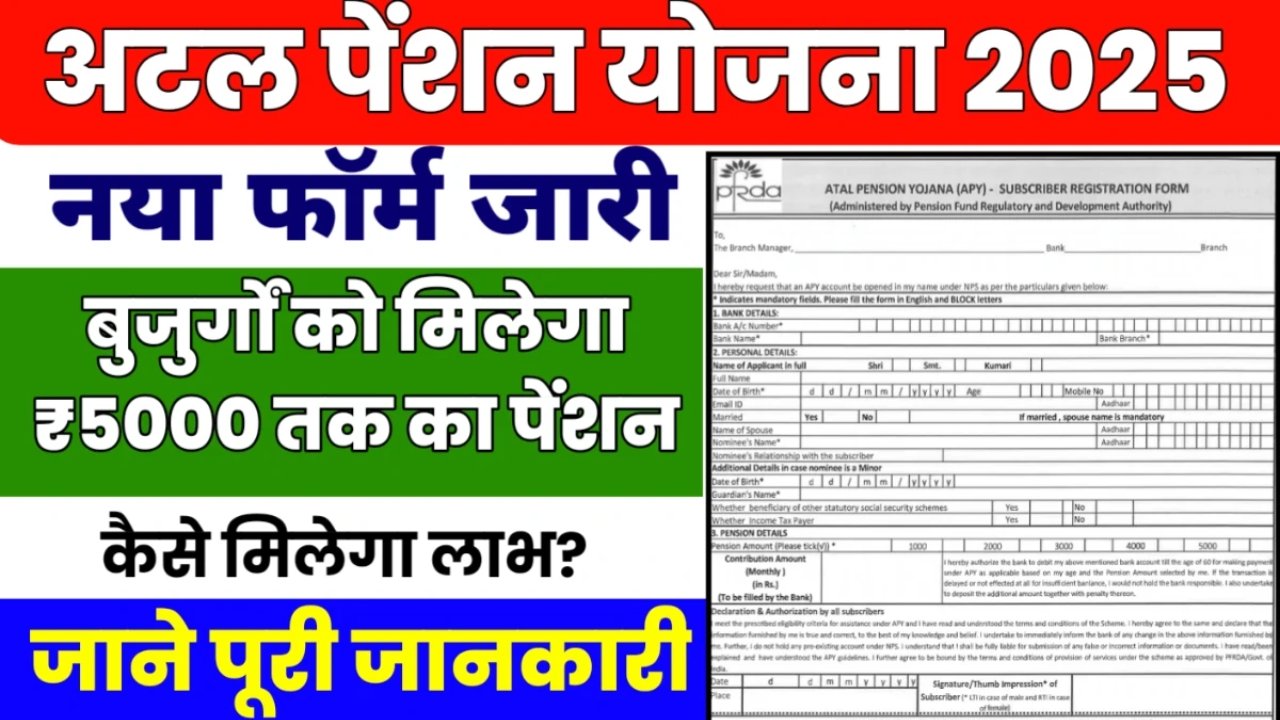

Atal Pension Yojana 2025: The Atal Pension Yojana 2025 is a significant scheme of the Government of India, under which ordinary citizens can secure their future in old age by depositing a small amount every month. Investors in this scheme receive a guaranteed monthly pension of ₹1,000 to ₹5,000 after the age of 60. The central government has released a new form for this scheme in 2025 and clarified that the old form will no longer be valid.

Atal Pension Yojana 2025

The Atal Pension Yojana (APY) was launched by Prime Minister Narendra Modi in 2015. Its primary objective is to provide financial assistance to unorganized sector workers and low-income individuals in their old age. Now, in 2025, the plan has undergone some significant changes, the most significant of which is the release of a new application form.

Atal Pension Yojana New Form

The government says the old form was now technically outdated. The new form mandates Aadhaar verification, nominee details, and mobile linking. This has made the application process more transparent and strengthened the security of pensioners’ data.

Atal Pension Yojana Eligibility

Any Indian citizen between the ages of 18 and 40 can apply for this scheme. Applicants must make monthly contributions for at least 20 years.

- If you are 18 years old then you will have to contribute ₹42 per month.

- If you are 40 years old, the contribution can be up to ₹291 per month.

The pension is determined after the age of 60 years depending on the amount chosen and your age .

Benefits of Atal Pension Yojana 2025

- Monthly pension guarantee ranging from ₹1000 to ₹5000 after the age of 60 years.

- Contribution will be made directly from the bank account through Auto Debit.

- If the contributor dies, the pension amount is given to the family member or nominee.

- Tax benefit is available under section 80CCD(1B).

- Now the application process is completely based on Digital Verification System.

How to Apply for Atal Pension Yojana

- Visit your nearest bank or post office where this scheme is available.

- Fill the new “Atal Pension Yojana 2025” form.

- Attach Aadhar card, bank passbook and mobile number.

- Activate Auto Debit facility in the bank account.

- After this you will be issued a PRAN (Permanent Retirement Account Number).

Determination of the amount of contributions and pension

The contribution amount depends on your age and pension amount. For example:

- If an 18 year old person has to pay ₹210 per month, he will get ₹5000 pension at the age of 60.

- A 30 year old person will have to pay ₹577 per month and he will be able to avail the benefit of ₹5000 monthly pension.

The most special thing about this scheme is that the pension is guaranteed by the Government of India, which means the contributor’s money will never go waste.

Changes as per the new notification 2025

- The old application form will no longer be valid.

- Biometric verification will now be mandatory in all applications.

- E-KYC based verification has now been made mandatory for closing APY account.

- Now Digital Pension Passbook facility has also been started under the scheme.

| Info In Gujarati | View |

Important points of APY

1. What is the minimum pension under the Atal Pension Yojana 2025?

The minimum pension is ₹1,000 per month.

2. What is the maximum pension available under the scheme?

The maximum monthly pension is ₹5,000.

3. Can I apply after the age of 40?

No, the maximum age limit is 40 years.

4. Will the old form still be valid?

No, only the new form issued in 2025 will be valid.

5. Is this scheme available in all banks?

Yes, this scheme is available in almost all nationalized and private banks.

Conclusion

Atal Pension Yojana 2025 is a very useful and reliable scheme for the poor and middle class. By filling out its new form, you can secure your future. If you are young now, this will prove to be a strong financial support for you until old age.