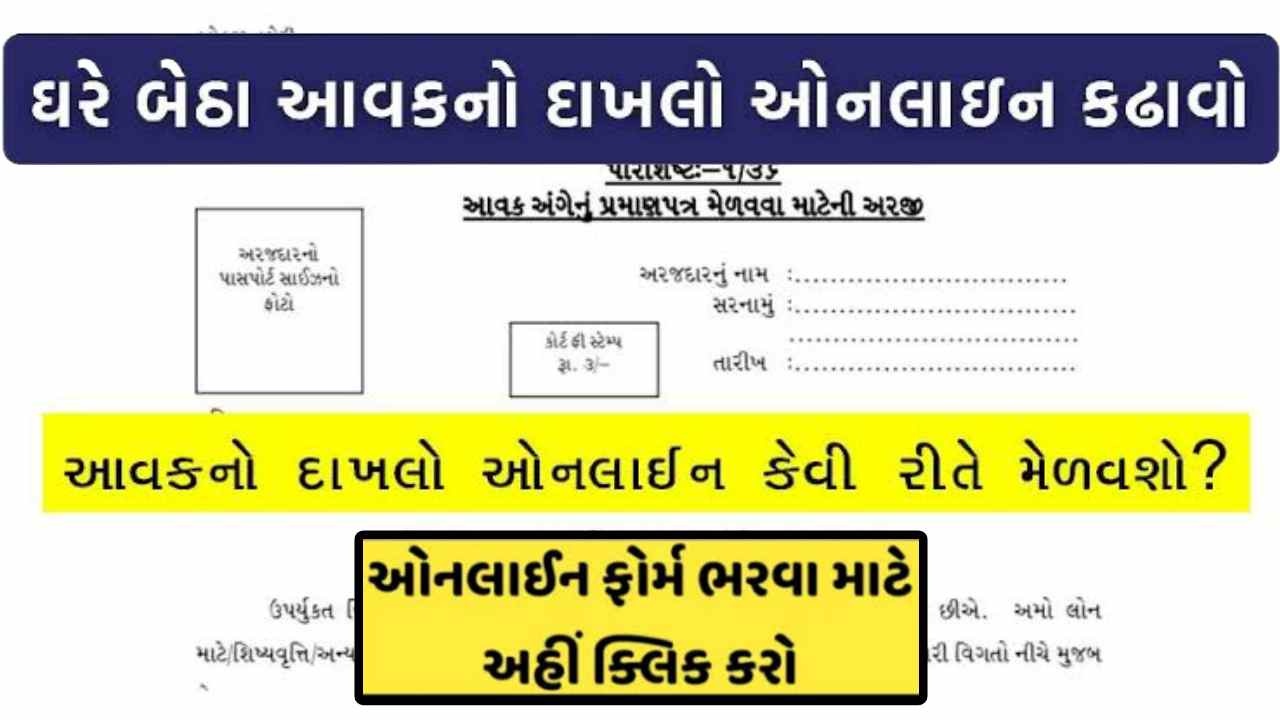

Aavak No Dakhlo From Degital Gujarat: Aavak No Dakhlo From Digital Gujarat @www.digitalgujarat.gov.in: Income Certificate is an official document issued by the State Government which states the annual income details of the applicant or family of the Candidate . The key Full Details specified in the certificate is information regarding the annual income of the family earned from various sources as per the records for a specific financial year.

Aavak No Dakhlo From Digital Gujarat

Aavak no dakhlo from digital Gujaratpdf How to apply for aavak no dakhlo from digital Gujarat Aavak no dakhlo from digital Gujarat online Aavak no dakhlo from digital Gujaratdownload Aavak no dakhlo from digital Gujaratonline apply aavak no. dakhlo Gujarati pdf download aavak no dakhlo form Aavak no dakhlo from digital Gujarat 2024

Income Certificate

Income certificate is mainly used for the following purposes:

- Helps to get special privileges from educational institutions.

- Backward classes make special reservations in college and universities.

- This certificate plays an important role to get credit from government banks and various government Yojana

- Old age pension, widow pension & agricultural worker pension will be issued on the income basis.

Eligibility

A person applying for income tax certificate should be a resident of the State of Gujarat.

Required Documents

The documents Needed to obtain Gujarat Income Certificate are given below:Address Proof (Anyone is mandatory):

- Ration Card

- Electricity bill

- Water bill (not older than three months)

- Gas connection

- Bank Passbook

- Post Office Account Statement / Passbook

- Driving License

- Govt. Photo ID cards / Service photo identity card issued by Public Sector Undertakings (PSU)

- Identity Proof (Anyone is mandatory):

- Election Card

- PAN Card

- Passport

- Identity card issued by an approved educational institution.

- Income Proof (Anyone is mandatory )

Employer Certificate (if employed with Government, Semi Government or any Govt-undertaking)If salaried (Form 16-A and ITR for Ending three years)If in business (ITR of Business for last Three years and Balance Sheet of Business)Declaration before Talati (Service Related)

Important Link

Thanks for visiting this useful post, Stay connected with us for more Posts. Visit every day for the latest offers of various brands and other technology updates.