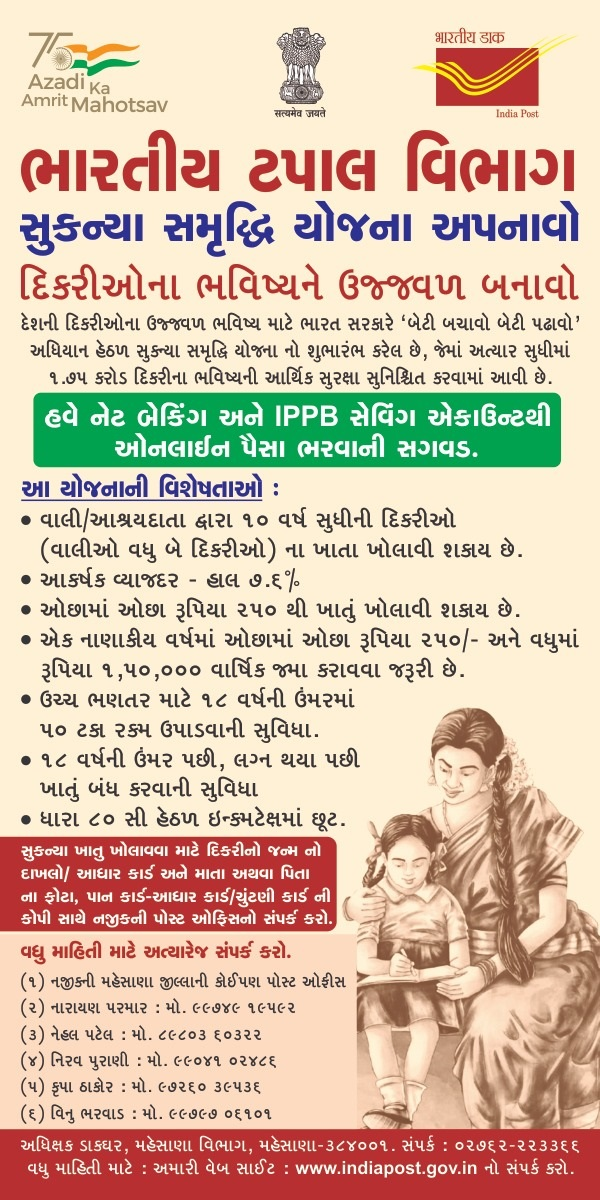

Sukanya Samriddhi Yojana Form: Sukanya Samriddhi Scheme has been launched by the government of India for the girl child in 2015 by the Ministry of Women and Child Development.Under the Sukanya Samriddhi Yojana, an account in the name of the girl child has to be opened by their natural or legal guardian from the birth of the girl till she attain the age of 10 years.

Sukanya Samriddhi Yojana Form

The minimum and maximum deposit amount is 250 and Rs.1,50,000 per fiscal year.If the customers fail to deposit that minimum amount then the penalty of Rs.50 will be imposed.After the payment of penalty, the account opened under the scheme became reactivated.The Sukanya Samriddhi Yojana account’s term lasts for 21 years from the date of opening or until the account holder’s marriage whichever is earlier.

Sukanya Samriddhi Yojana Eligibility Criteria

- Account of the girl child can be opened by their natural parents or legal guardian.

- The girl child ought to be under 10 years at the time of opening account.

- The account should be operational till the girl child becomes 21 years old.

- The minimum and maximum amount to be deposited in the account is 250 and Rs.1,50,000.

- An individual girl child cannot have numerous Suknya Samriddhi Accounts.

- Only two Suknya Samriddhi Accounts are permitted per family i.e. one for each.

Sukanya Samriddhi Yojana Benefits

- High Interest Rates: Suknya Samriddhi Yojna offers high interest rates which is currently 8% in comparison to other government schemes and bank deposits.

- Guaranteed Return: Suknya Samriddhi Yojna is a government’s scheme which provides guaranteed return.

- Tax Benefits: SSY provides tax deduction benefits under section 80C upto Rs.1.5 lakh annually.

- Flexible Investment: Under SSY there is no fixed amount that is to be deposited in the account of the beneficiary but it should be minimum Rs.250 and maximum Rs.1.5 lakh.

- Benefit of Compounding: SSY is a scheme of long-term investment as it provides the benefit of annual compounding.

- Convenient Tranfer: SSY can be freely transferred from one part of the country to another in case of transfer of parent/guardian.

Sukanya Samriddhi Yojana (SSY) Documents

- Sukanya Samriddhi Yojana Account Opening form.

- The girl child’s Birth Certificate must include her name.

- A photograph of the parent or legal guardian of the girl child.

- KYC Documents (Identity and Address Proof) of the parent or guardian.

How To Open Sukanya Samriddhi Yojana Account

- Visit the nearest bank or post office.

- Fill the application form of Suknya Samriddhi Yojna which is SSA-1 form.

- This form can also be downloaded online.

- After filling the form, submit the form with the desired documents.

- After submitting the documents, pay the first deposit which is minimum of Rs.250.

- SSY account will be opened and passbook will be issued by the bank or post office for the account.

Premature Withdrawal in other cases

In case of death of the girl chid, the amount can be withdrawn by her parents/guardian after submitting the desired documents.

The account will be closed if the girl is no longer a citizen of India.

Important Links

| Download Press Note | View |

Thanks for visiting this useful post, Stay connected with us for more Posts. Visit every day for the latest offers of various brands and other technology updates.