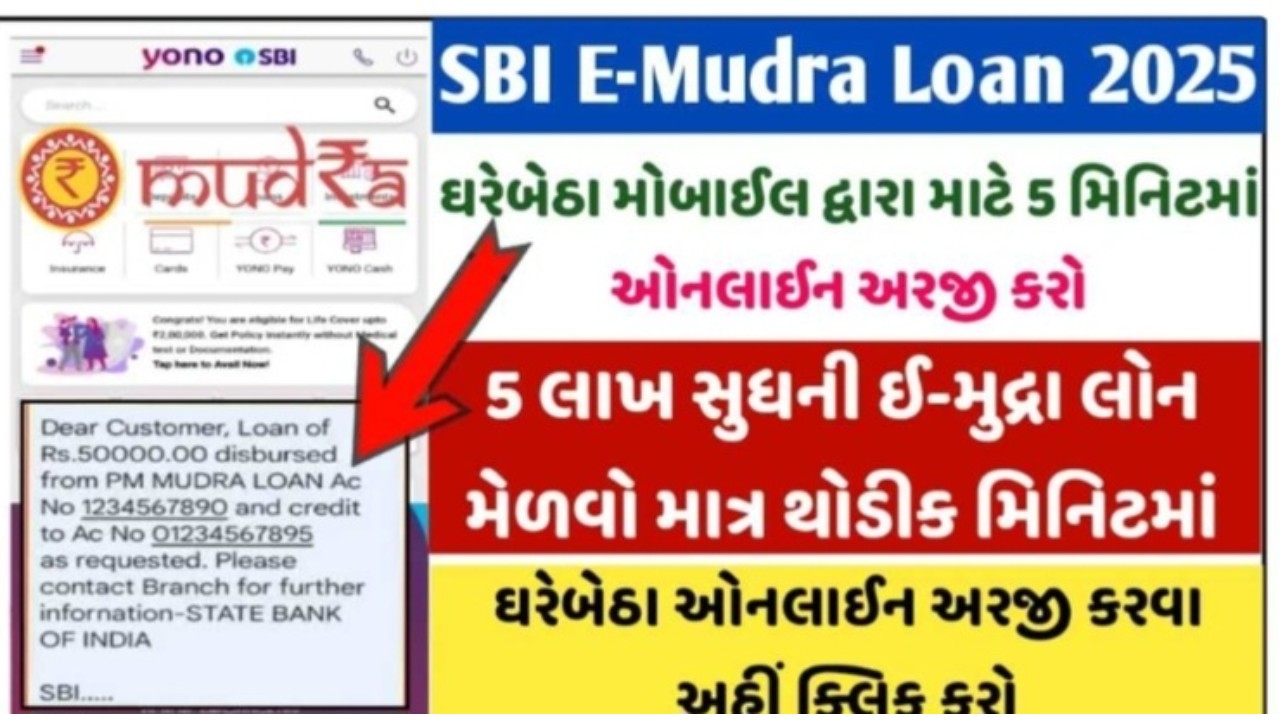

SBI E-Mudra Loan Apply Online 2026 : SBI E-Mudra Loan is a financial product offered by State Bank of India (SBI) as part of Pradhan Mantri Mudra Loan Scheme. This scheme is designed to provide funds to individuals who want to start or expand their small business in India.

Under the SBI e-Mudra Loan Scheme, individuals can apply for a loan of up to INR 50,000 to help get their business off the ground. Loans can be used for various purposes, including purchase of equipment and machinery, recruitment of employees, marketing and advertising,

etc.SBI e-Mudra Loan helps you. Citizens who have a savings account or a current account in State Bank of India will be eligible for an e-Mudra loan up to Rs 50,000 under SBI e-Mudra Loan Apply Online 2025.

SBI E-Mudra Loan Apply Online 2026

| Name of the scheme | Pradhan Mantri Mudra Loan Yojana (PMMY) |

| Name of the Article | SBI e-Mudra Loan Apply Online 2025 |

| Who initiated the plan? | A scheme launched by the Prime Minister of the country to provide loans of up to 10 lakhs to non-corporate, non-agricultural small/micro enterprises. |

| When did the scheme start? | April 8, 2015 |

| Objective of the scheme | The scheme has been launched to help small scale businesses, companies, units of India grow and reach fruition. |

| Official website | https://www.mudra.org.in/ |

| SBI Website Link | https://sbi.co.in/ |

Overall, SBI e-Mudra Loan is a valuable financial tool for individuals looking to start or grow their small business in India. With its convenient application process and accessible loan amount, it is an attractive option for those seeking financial assistance to get their business off the ground.

SBI Mudra Loan Scheme

To be eligible for SBI e-Mudra loan, you must have a savings account or current account with SBI. The loan application process is quick and easy, and can be completed completely online through the SBI website.

One of the main advantages of SBI e-Mudra Loan is that it is designed to be accessible and convenient for small business owners. With a simple application process and fast turnaround time, it is a practical solution for those in need of funding to start or expand their business.

Required Documents of SBI E-Mudra Loan

You will need to provide certain documents to the bank as part of the application process. These documents may vary depending on the type of business you are starting and your personal financial situation. Below is a list of some common documents that you may be asked to provide while applying for an SBI e-Mudra loan:

e-Mudra Loan can be availed online from State Bank of India. In which small businessmen can take loans up to 1 lakh rupees. But it will require some documents. But applying for a loan up to Rs 50,000/- will require the following documents.

- First of all top SBI e-Mudra Loan on GoogleVisit the SBI website and click on the “Loans” tabFrom the list of loan options, select “E-Mudra Loan”.Apply Now” Button Click HareFill the online application form with your personal and financial information. Be sure to provide accurate and complete information to avoid any delay in the process.Upload the required documents, including proof of identity, address, business plan, financial documents and any other required documents.Submit the completed application form and wait for the response from the bank.

Proof of address: This can be a copy of your utility bill, rental agreement or passport

Proof of Ownership: If you already own a business, you will be asked to provide proof of ownership, such as a deed or registration certificate

Customer should have savings account or current account

Apart from this, it is necessary to give a certificate of whatever business or business you are doing.

Apart from that, GSTN Number and business along with the extent of shop or business

If you belong to reserved category, caste certificate also has to be provided.

Identity Proof: This can be a copy of your PAN Card, Voter ID Card or Passport.

Business Plan: You will need to provide a detailed business plan outlining your business goals, target market, financial projections and more.Financial documents: You may be asked to provide financial documents such as your bank statements, income tax returns and balance sheets

Guarantor Details: Depending on your credit history and financial situation, you may be asked to provide details of the guarantor who will co-sign your loan

The customer has to give his branch details.

Aadhaar number should be linked with your bank account.

If you belong to reserved category, caste certificate also has to be provided.

It is important to note that this is not an exhaustive list of all the documents required while applying for SBI E-Mudra Loan. Depending on your specific circumstances you may be asked to provide additional documentsSBI E-Mudra Loan Helpline

Phone: You can call SBI e-Mudra Loan Helpline at 1800-11-2211 or 1800-425-3800. The customer service team is available 24/7 to assist you with any questions or issues you may have

Email: You can send an email to the SBI Customer Care Team at contactcentre@sbi.co.in.

Online Chat: You can use the online chat facility on the SBI website to connect with a customer service representative in real-time.

Social Media: You can also contact SBI through their social media accounts on platforms like Facebook and Twitter

Face-to-face: If you prefer to speak to a customer service representative face-to-face, you can visit your nearest SBI branch for assistance.

ObjectsLink & Helpline NumberMudra Office AddressSWAVALAMBAN BHAVAN, C-11, G-BLOCK, BANDRA KURLA COMPLEX, BANDRA EAST, MUMBAI-400 051SBI Helpline1800 11 2211, 1800 425 3800, 080-26599990Mudra Helpline1800 180 1111/1800110001How To SBI E-Mudra Loan Apply Online?Applying Applying online for SBI e-Mudra Loan is a quick and easy process.To get started, follow the steps below:

Thanks for visiting this useful post, Stay connected with us for more Posts. Visit every day for the latest offers of various brands and other technology updates.